Form 1040 allows eligible farmers and fishermen to report yearly income correctly even if estimated tax payments were skipped, as long as IRS conditions and deadlines are met.

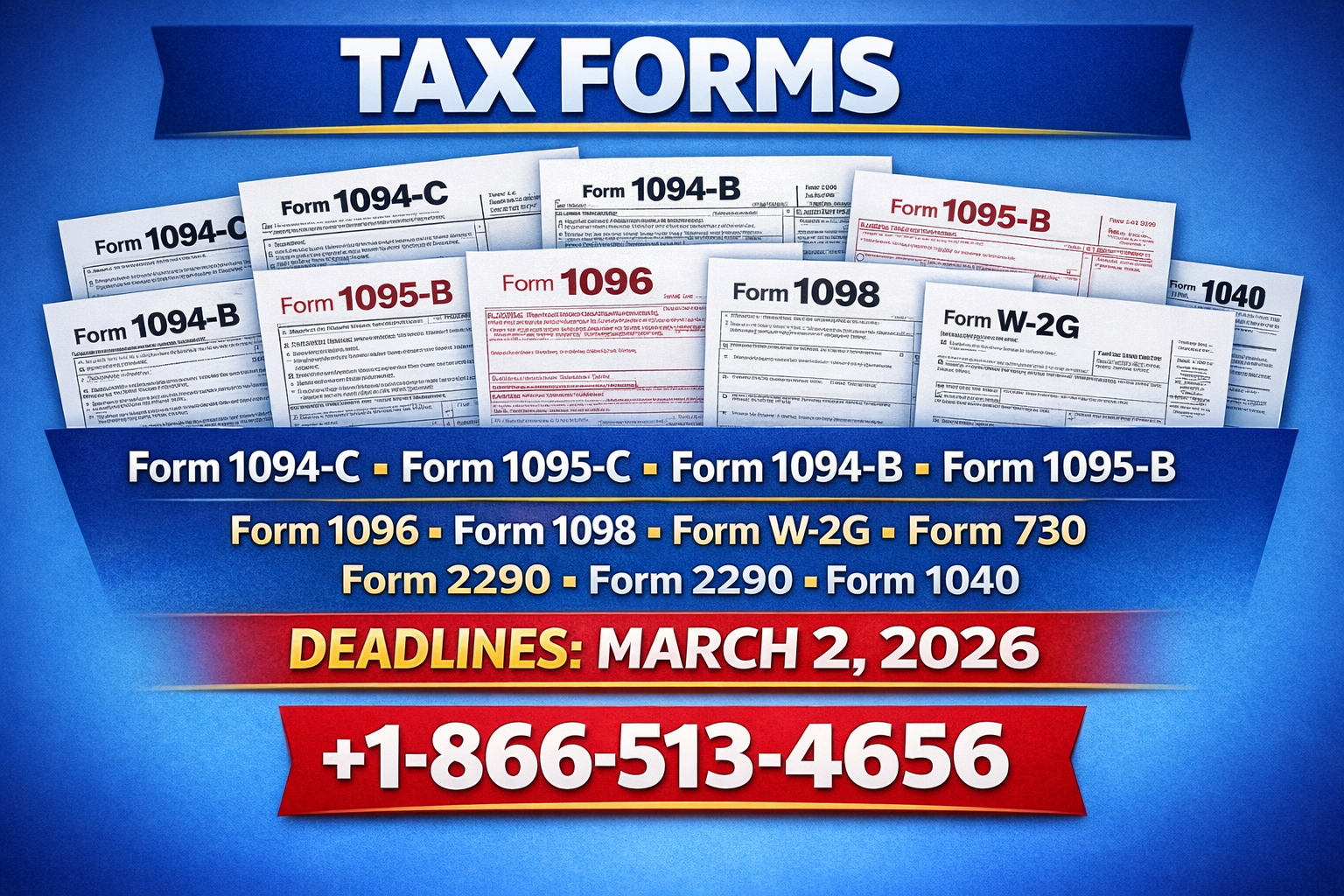

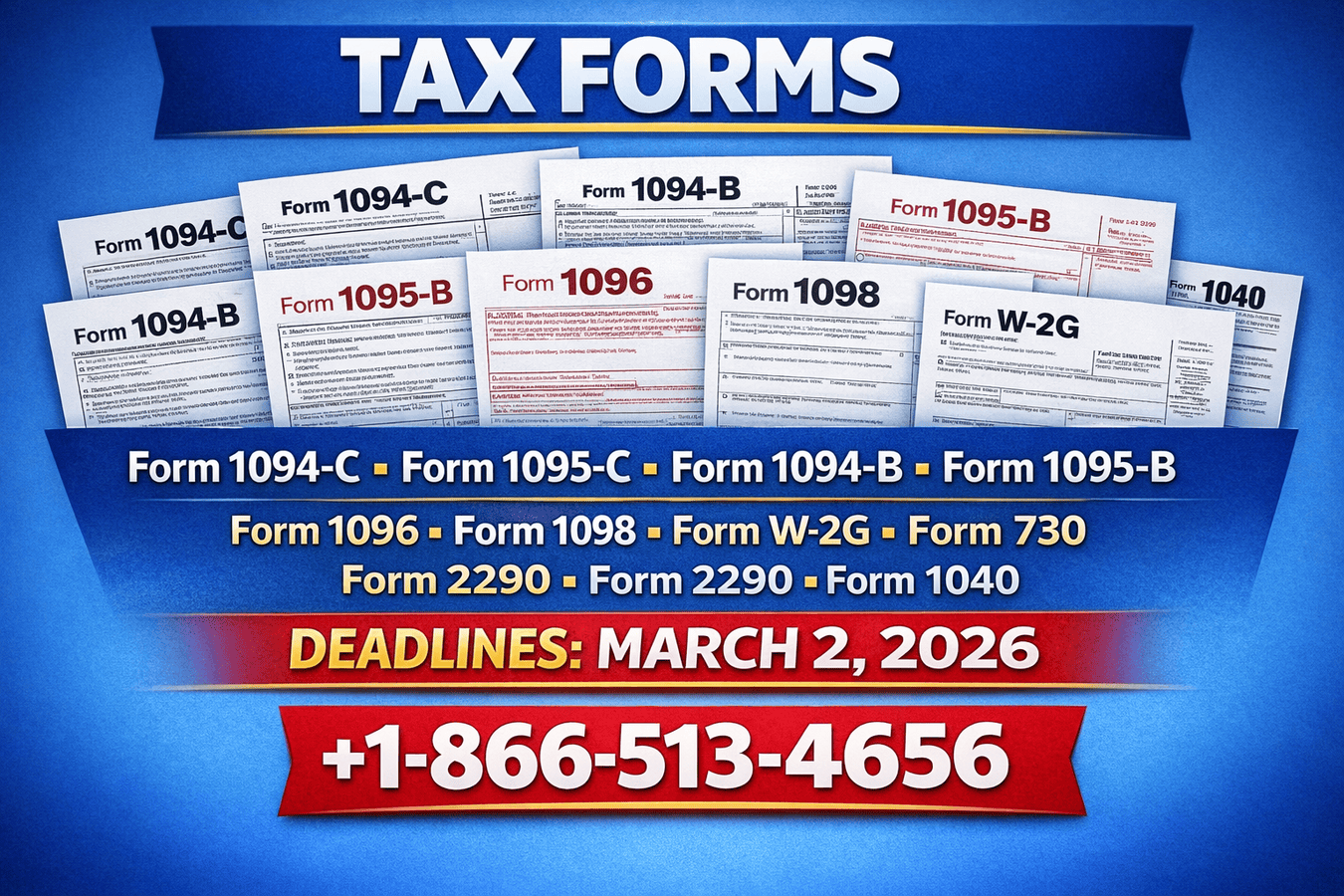

Form 1040 Explained | Step-by-Step Tax Return Help. Call +1-866-513-4656 for expert help and guidance.

Life on a farm or at sea rarely follows neat schedules. Crops depend on weather, and fishing depends on tides, not tax calendars.

The IRS recognizes this reality. That is why Form 1040 includes special considerations for farmers and fishermen who could not meet estimated tax payment rules.

Table of Contents

Understanding Form 1040

Why Estimated Taxes Are Different for Farmers and Fishermen

Eligibility Rules You Should Know

Common Filing Mistakes to Avoid

How Booksmerge Helps Seasonal Earners

Trusted IRS Resources

Conclusion

FAQs

Understanding Form 1040

Form 1040 is the primary document individuals use to report income to the IRS.

For farmers and fishermen, this form reflects income that often arrives in lump sums rather than steady paychecks.

Even if estimated tax rules were missed, Form 1040 still provides a compliant path to file and settle taxes correctly.

Why Estimated Taxes Are Different for Farmers and Fishermen?

Most self-employed individuals pay taxes quarterly.

Farmers and fishermen face unpredictable income cycles. One good harvest or a strong fishing season may define the entire year.

The IRS allows qualifying individuals to pay taxes annually instead of quarterly, reducing unnecessary penalties.

Eligibility Rules You Should Know

Not everyone qualifies for this exception.

The IRS generally requires that at least two thirds of your gross income comes from farming or fishing activities.

If you meet this rule, you may file Form 1040 without following standard estimated tax payment schedules.

If you are unsure about eligibility, professional guidance is available at +1-866-513-4656.

Common Filing Mistakes to Avoid

Many taxpayers run into trouble because of small oversights.

Missing the annual filing deadline

Incorrectly calculating farming or fishing income

Failing to confirm eligibility before skipping estimated payments

Ignoring IRS notices

These mistakes can lead to penalties even when exceptions apply.

Quick assistance from experts at +1-866-513-4656 can prevent costly errors.

How Booksmerge Helps Seasonal Earners?

Booksmerge specializes in supporting farmers and fishermen who deal with complex income patterns.

The team focuses on accurate reporting, IRS-aligned compliance, and clear communication.

Instead of guessing tax rules, clients receive structured guidance designed for real-world seasonal work.

For reliable filing support, contact +1-866-513-4656 today.

Trusted IRS Resources

For official and verified information, refer to these IRS resources:

Conclusion

Form 1040 offers farmers and fishermen a fair way to meet tax obligations even when estimated payments were missed.

Understanding eligibility, filing on time, and using trusted support keeps seasonal earners compliant and stress free.

FAQs

1. Do farmers still need to file Form 1040 if income was low?

Yes, filing may still be required depending on IRS income thresholds.

2. Can fishermen avoid penalties without estimated payments?

Yes, if IRS income requirements and deadlines are met.

3. Is professional help necessary?

It is not mandatory, but expert guidance reduces errors and risk.

4. Where can I get reliable assistance?

Booksmerge and IRS resources provide dependable support.

Write a comment ...