Form W-2G is used to report gambling winnings like lottery prizes, poker payouts, and casino jackpots to the IRS, helping winners comply with federal tax regulations.

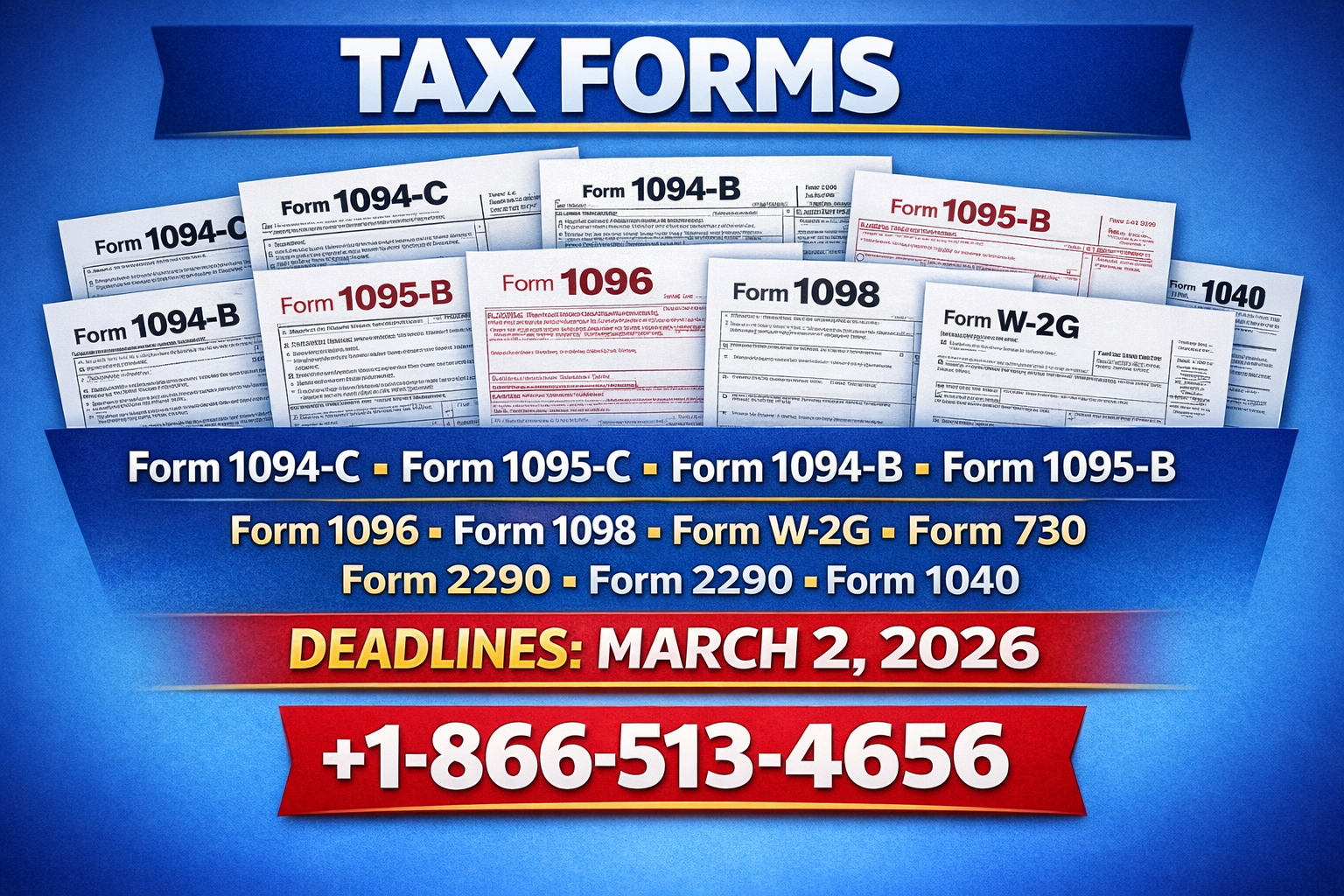

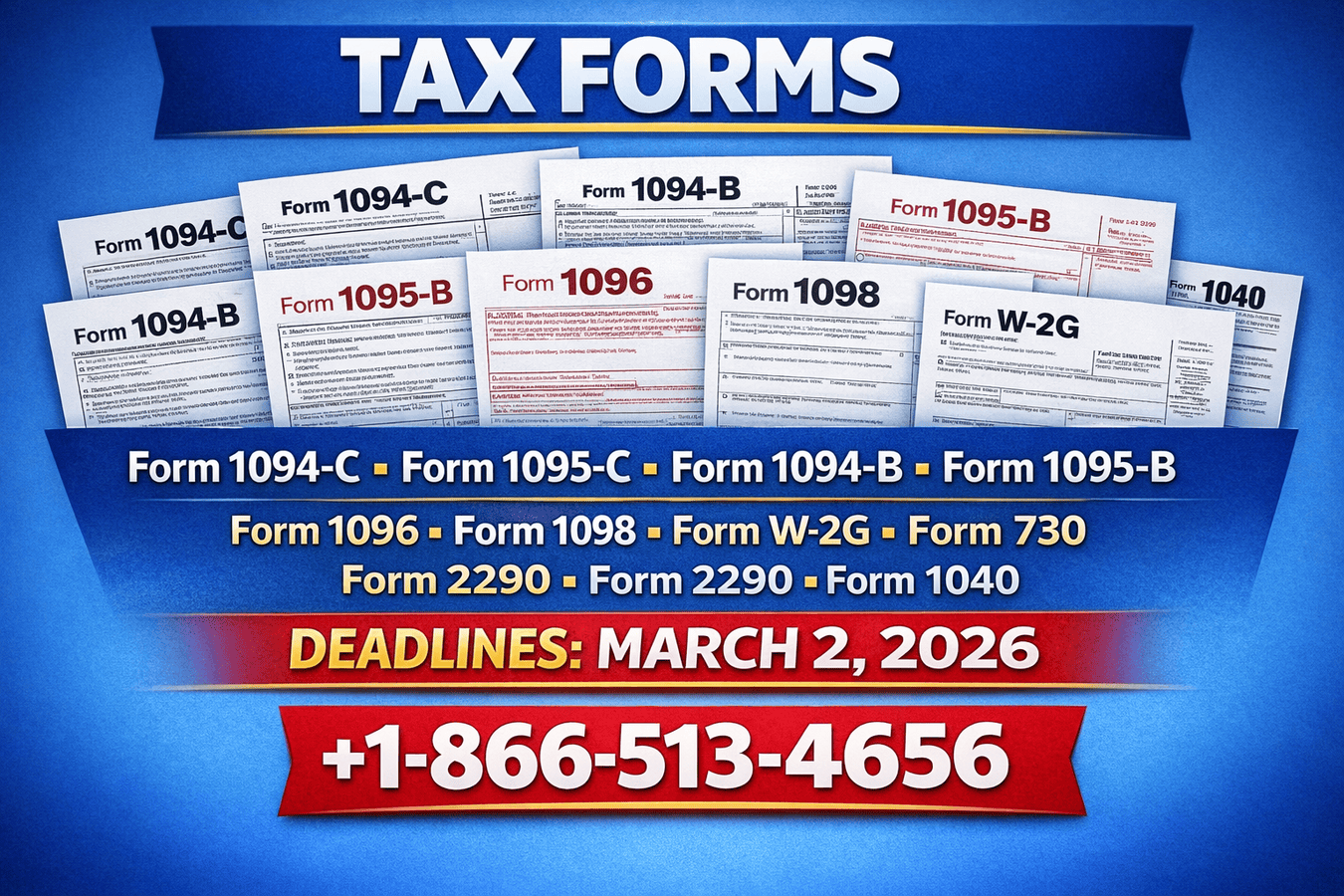

Form W-2G Requirements Explained | March 2, 2026. Call +1-866-513-4656 for expert help.

Winning big is thrilling, but the IRS still expects its share. Filing Form W-2G ensures your gambling income is properly reported, helping you avoid penalties and mistakes during tax season.

Casinos, lotteries, and other gaming institutions must issue Form W-2G to winners exceeding IRS thresholds. Understanding how to handle this form protects both payers and winners.

Table of Contents

What Is Form W-2G?

Who Should Receive Form W-2G?

IRS Reporting Thresholds

Steps to Complete Form W-2G

Common Mistakes to Avoid

Trusted IRS Sources

Conclusion

FAQs

What Is Form W-2G?

Form W-2G reports gambling winnings to the IRS, including lottery prizes, bingo, raffles, and casino payouts. The form also lists federal income tax withheld from the winnings.

Even if you don’t receive a W-2G, all gambling winnings are taxable and must be reported on your tax return.

Who Should Receive Form W-2G?

Individuals who win amounts above IRS thresholds receive Form W-2G. Payers also submit a copy to the IRS to maintain compliance.

Common recipients include lottery winners, poker champions, and slot machine jackpot winners.

IRS Reporting Thresholds

Form W-2G is required when winnings exceed the following:

$600 for bingo, keno, and raffles

$1,200 for slot machines and poker tournaments

$1,500 for horse racing payouts

Other IRS-specified thresholds may apply

Federal income tax may be withheld on large winnings. Call +1-866-513-4656 for expert guidance if unsure.

Steps to Complete Form W-2G

Enter the payer’s name, address, and Tax Identification Number (TIN)

Include the winner’s name, address, and Social Security Number (SSN)

Report the exact amount of gambling winnings

List any federal tax withheld

Double-check all entries to prevent IRS corrections or audits.

Common Mistakes to Avoid

Incorrect Social Security numbers or TIN

Miscalculated winnings

Omitting federal tax withheld

Not submitting the form to the IRS on time

Careful review and professional assistance can help avoid these issues.

Trusted IRS Sources

Conclusion

Form W-2G ensures accurate reporting of gambling winnings. Filing correctly protects winners and payers from IRS penalties and compliance issues.

Booksmerge helps with accurate filing of gambling income and other tax forms. For professional assistance, call +1-866-513-4656.

FAQs

1. What types of gambling winnings require Form W-2G?

Lottery prizes, casino jackpots, bingo, keno, poker, and horse racing winnings above IRS thresholds.

2. Do all gambling winners get a W-2G?

No. Only winners whose winnings exceed IRS minimum reporting thresholds receive Form W-2G.

3. Can I file Form W-2G electronically?

Yes. Large payers often file electronically, while smaller institutions may use paper forms.

4. Where can I find official instructions for Form W-2G?

Visit IRS Form W-2G page for complete guidance.

Write a comment ...