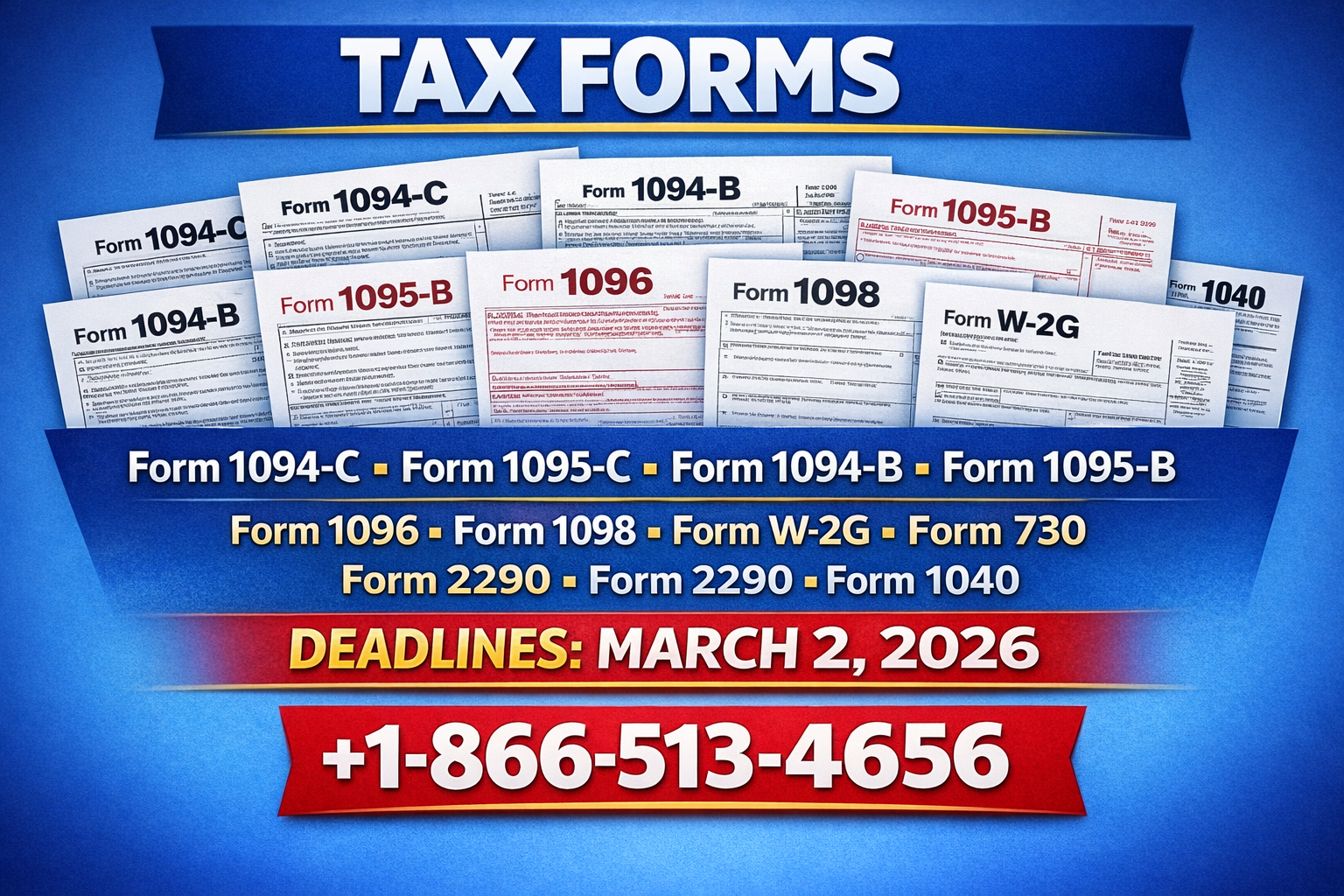

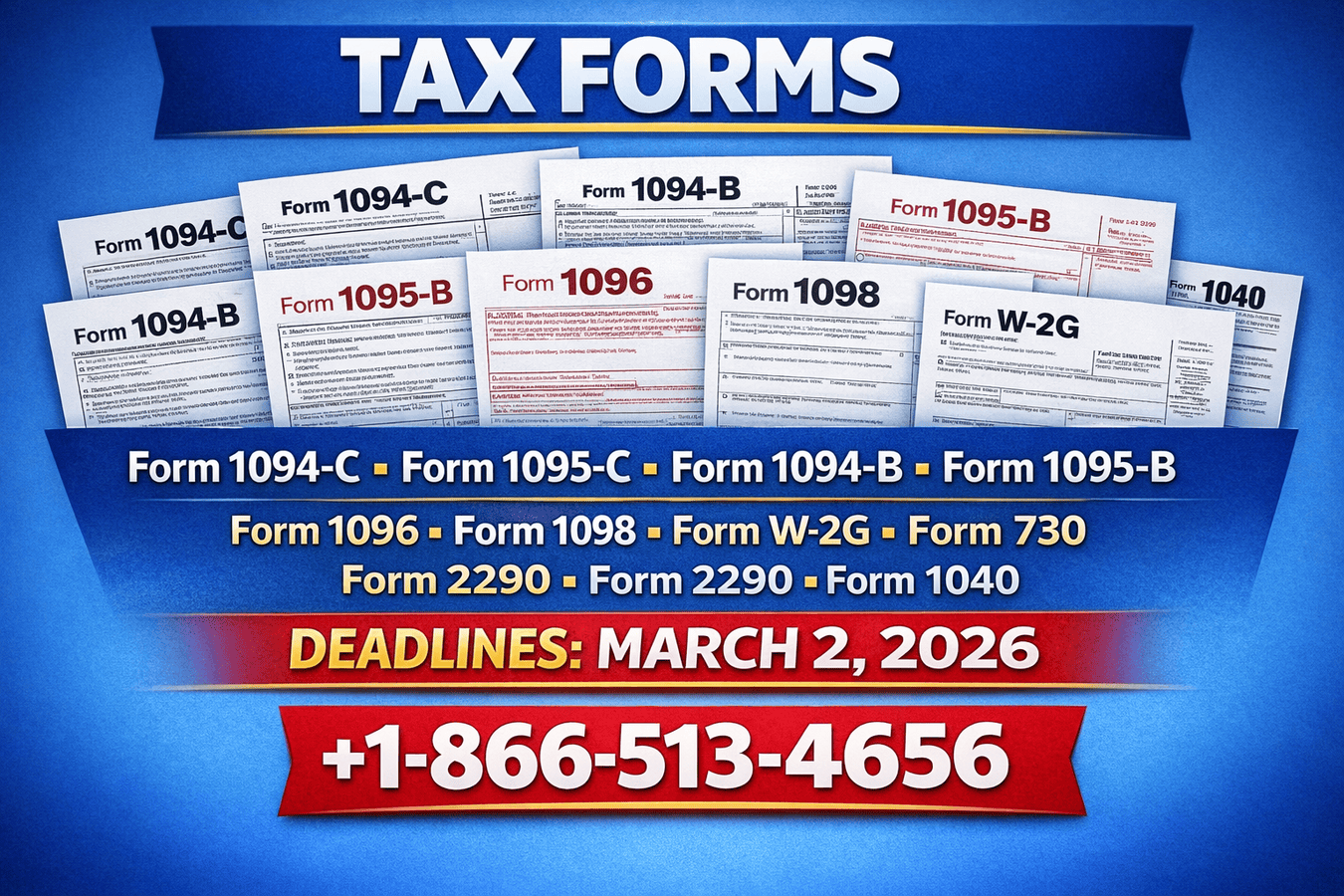

Form 1095-C is the IRS form employers use to report health insurance offers to full-time employees, verifying ACA compliance. Call +1-866-513-4656 for expert assistance.

Filing Form 1095-C might seem complex, but it is mainly a documentation tool. It shows which employees were offered health coverage, the type of coverage, and whether it meets ACA standards. Accurate filing keeps both employers and employees safe from penalties.

Form 1095-C – Employer-Provided Health Insurance Offer and Coverage (paper). Experts are just a phone call away at +1-866-513-4656.

Introduction to Form 1095-C

Form 1095-C, officially called “Employer-Provided Health Insurance Offer and Coverage,” is a reporting requirement for Applicable Large Employers (ALEs). It documents the health coverage offered to full-time employees throughout the year.

The form also helps employees verify their coverage and claim premium tax credits if eligible.

Who Must File?

Employers with 50 or more full-time or full-time equivalent employees must file Form 1095-C. Each full-time employee receives a copy, and employers submit a transmittal form, 1094-C, to the IRS.

Smaller employers do not typically need to file, unless they sponsor self-insured health plans. If you’re uncertain about your filing obligations, call +1-866-513-4656.

How the Form Works?

Form 1095-C includes information about the months coverage was offered, enrollment status, and cost of the lowest-cost plan available. Employers submit the form to both employees and the IRS.

This reporting confirms compliance with ACA regulations.

Important Sections of Form 1095-C

Employee information: name, Social Security Number, address

Employer information: name, EIN, and contact details

Coverage offered and months available

Employee enrollment status

Certification of ACA-compliant coverage

Even small errors can trigger IRS notices. For expert verification or corrections, call +1-866-513-4656.

Deadlines and Filing Guidelines

Paper forms must be submitted by February 28, while electronic filings are due by March 31. Preparing early allows you to double-check data and avoid penalties.

Importance of Accuracy

Correct reporting protects employers from fines and ensures employees can claim the correct premium tax credits. Accurate filing demonstrates compliance and good administrative practices to the IRS.

Trusted IRS Sources

For official guidance, refer to these trusted IRS resources:

Frequently Asked Questions

1. Who must file Form 1095-C?

Applicable Large Employers (ALEs) with 50 or more full-time employees.

2. Do employees receive Form 1095-C?

Yes, each full-time employee receives their own form for tax reporting purposes.

3. What happens if the form is filed late?

Late submissions may result in IRS penalties. For guidance to meet deadlines, call +1-866-513-4656.

4. Can the form be submitted electronically?

Yes, employers filing 10 or more forms must submit electronically. Deadline is March 31.

Write a comment ...