Form 730 is an IRS monthly excise tax form used by wagering operators to report and pay federal tax on taxable bets such as lotteries and betting pools.

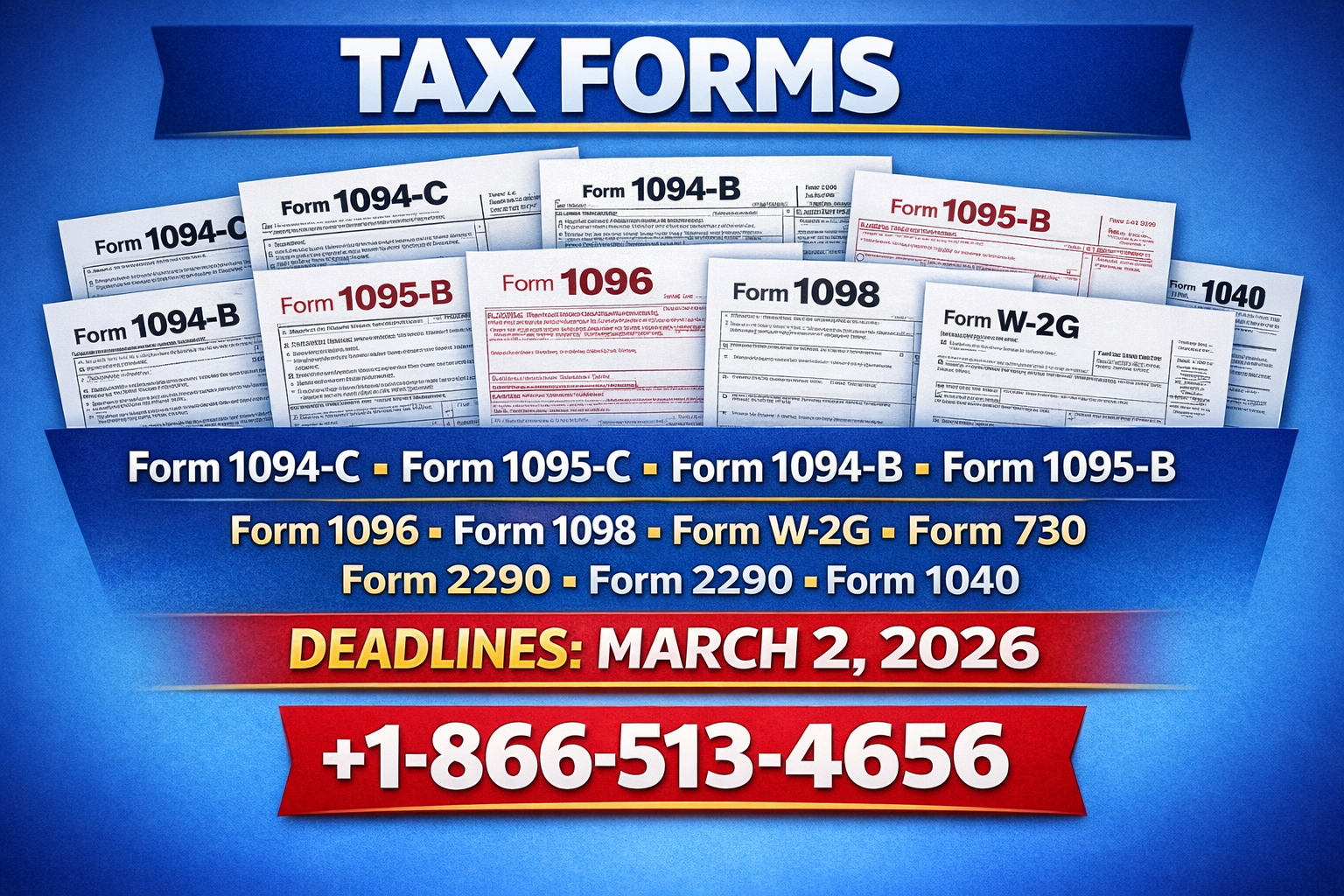

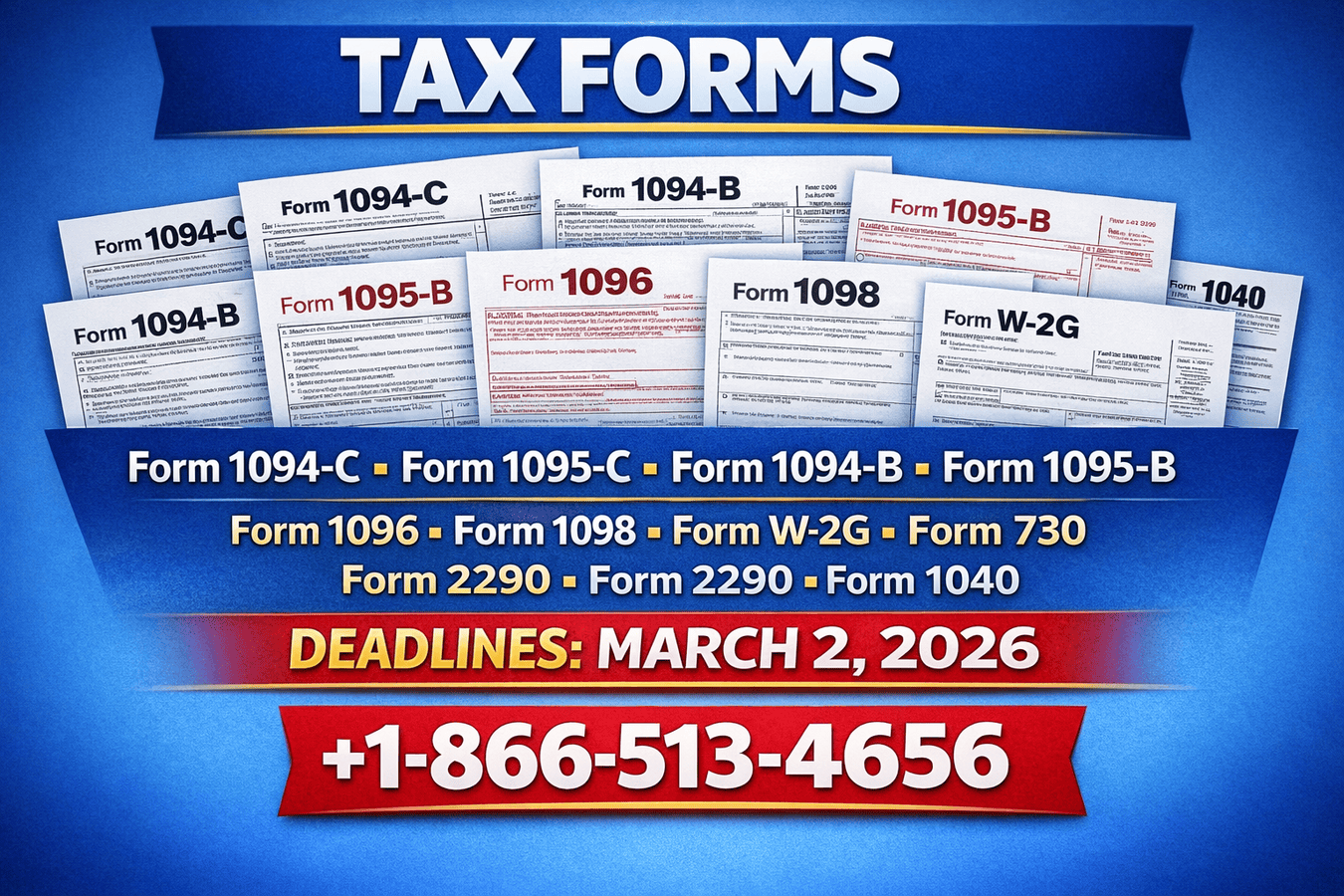

Form 730 Explained | Complete Guide Before March 2, 2026. Call +1-866-513-4656 for expert support.

Wagering businesses often focus on numbers, odds, and payouts. Taxes, however, play an equally important role. Form 730 ensures wagering taxes are reported correctly and on time.

Many beginners assume wagering tax reporting works like annual tax filing. In reality, Form 730 follows a monthly cycle, which makes accuracy and consistency essential.

Table of Contents

Purpose of Form 730

Who Is Required to File

Wagering Activities Covered

How to Prepare Form 730

Tips for Stress-Free Filing

Trusted IRS Sources

Conclusion

FAQs

Purpose of Form 730

Form 730 allows the IRS to collect federal excise tax on wagering activities. It applies to operators who accept bets that fall under IRS excise tax regulations.

The form covers a single month of activity, such as January. Each filing reports total wagers accepted and calculates the excise tax owed.

Who Is Required to File

You must file Form 730 if you accept wagers subject to federal excise tax. This requirement applies to both businesses and organizations.

Lottery and raffle organizers

Horse racing tracks and pools

Sports or betting pool operators

Any entity involved in taxable wagering

If you are unsure about your filing responsibility, professional guidance is available at +1-866-513-4656.

Wagering Activities Covered

The IRS identifies several wagering activities that trigger excise tax reporting:

Lotteries and number games

Pari-mutuel wagering on horse races

Organized betting pools

Other wagering arrangements defined by IRS rules

Knowing which wagers qualify helps prevent underreporting and compliance issues.

How to Prepare Form 730

Preparing Form 730 requires careful attention to detail. Follow these steps:

Confirm the correct reporting month

Enter accurate business details and EIN

Total all taxable wagers accepted

Apply the correct excise tax rates

Submit the form with payment to the IRS

Errors often occur due to rushed calculations or incorrect tax rates.

Tips for Stress-Free Filing

Maintain monthly wagering records

Review IRS instructions before filing

Double-check figures before submission

File early to avoid last-minute errors

Support is available at +1-866-513-4656 if questions arise during filing.

Trusted IRS Sources

Use official IRS resources for accurate information:

Conclusion

Form 730 plays a key role in wagering tax compliance. Monthly filing keeps operators aligned with IRS requirements and avoids unnecessary penalties.

Booksmerge assists businesses with accurate Form 730 filing and excise tax compliance. For expert help, contact +1-866-513-4656.

FAQs

1. Is Form 730 filed monthly?

Yes. Form 730 is filed monthly when taxable wagering activity occurs.

2. What happens if Form 730 is incorrect?

Incorrect filings may result in IRS notices, penalties, or interest charges.

3. Are small wagering organizations required to file?

Yes. If wagering meets IRS excise tax rules, filing is required regardless of size.

4. Where can I find official IRS instructions?

You can review guidance on the IRS Form 730 page.

Write a comment ...