Form 1096 is an IRS paper transmittal form that summarizes information returns like 1099s and must be attached when businesses submit those forms by mail.

Paper filing feels old school, but many businesses still use it. When you choose paper, the IRS expects one thing first: Form 1096.

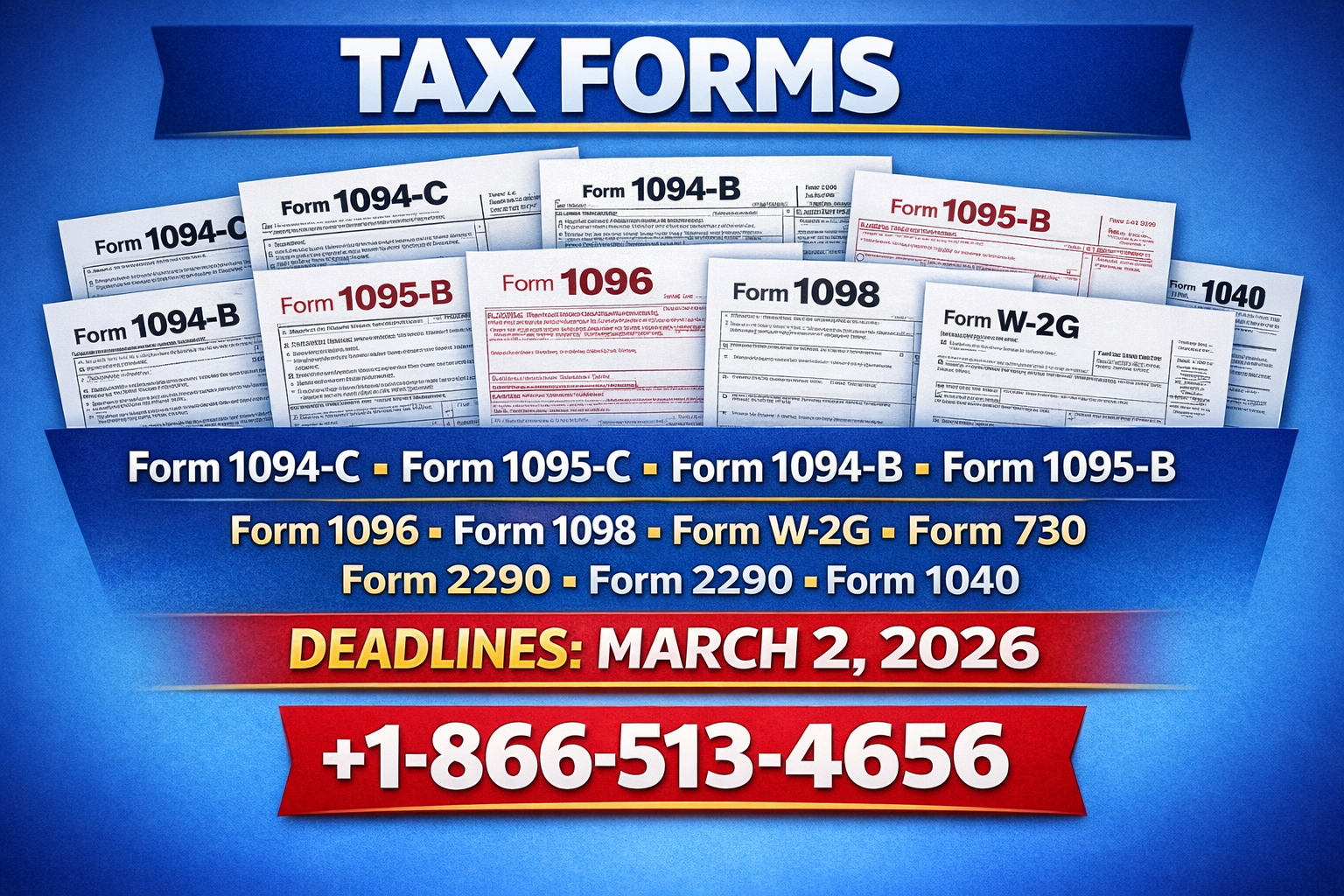

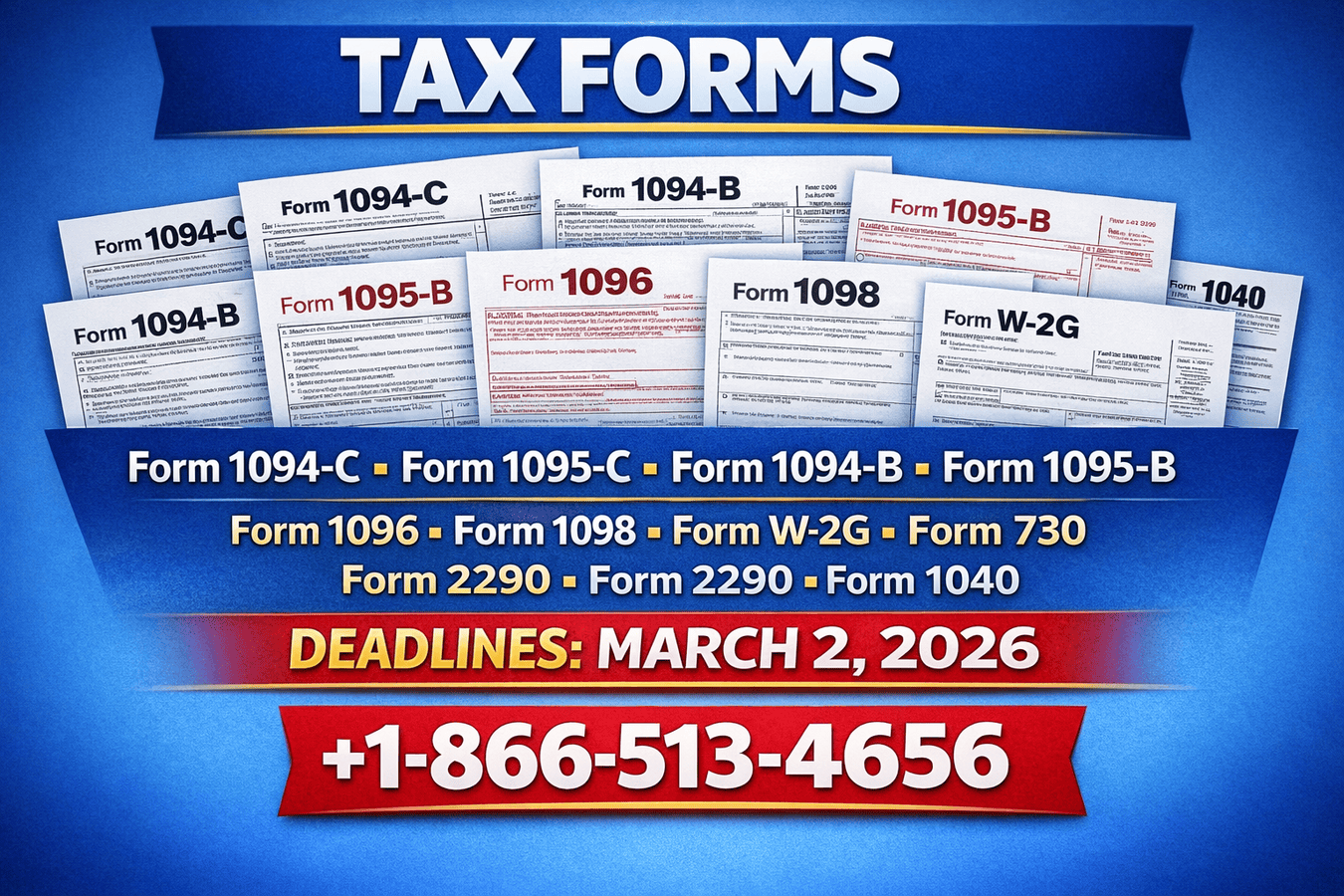

If confusion strikes early, support is available at +1-866-513-4656.

Table of Contents

What Form 1096 Really Does

Why the IRS Cares About It

Who Must Use Form 1096

Forms That Go With It

How to Fill It Out Correctly

Trusted IRS Sources

Conclusion

FAQs

What Form 1096 Really Does?

Think of Form 1096 as the cover letter for your paper-filed tax forms. It tells the IRS how many forms you sent and what totals those forms report.

Without this summary, the IRS has no clear starting point. That usually leads to processing delays or notices nobody enjoys opening.

Why the IRS Cares About It?

The IRS processes millions of information returns every year. Form 1096 helps them organize paper submissions faster.

Accurate totals reduce mismatches and follow-up letters. In simple terms, Form 1096 saves everyone time.

Who Must Use Form 1096?

If you file information returns by mail, you must include Form 1096. This applies mainly to businesses filing fewer forms or those approved for paper filing.

Electronic filers skip this form entirely. Unsure which category you fall into? Call +1-866-513-4656 for clarity.

Forms That Go With It

Form 1096 must accompany paper submissions of forms such as:

Form 1099-NEC

Form 1099-MISC

Form 1099-INT

Form 1099-DIV

Form 1098

Important tip: each form type needs its own Form 1096. Mixing them often triggers IRS rejections.

How to Fill It Out Correctly?

Filling out Form 1096 does not require advanced tax knowledge. It requires attention:

Use the official red-ink IRS form.

Enter your business name and EIN accurately.

Check the box that matches your attached form.

Enter total form count and dollar amounts.

Sign and date before mailing.

Many errors happen because filers rush. That is why businesses rely on experts at +1-866-513-4656.

Trusted IRS Sources

Always confirm rules using official IRS guidance:

Using IRS sources strengthens compliance and builds trust with search engines.

Conclusion

Form 1096 may look small, but it carries big responsibility. It connects your paper filings to the IRS system correctly.

Booksmerge helps businesses handle information returns with accuracy and confidence. For professional assistance, contact +1-866-513-4656.

FAQs

1. Is Form 1096 required for every paper filing?

Yes. The IRS requires Form 1096 with all paper-filed information returns.

2. Can I print Form 1096 from the IRS website?

No. The IRS requires the official scannable version ordered directly from them.

3. Do I need multiple Form 1096 copies?

Yes. Each type of information return needs a separate Form 1096.

4. Where can I check updated filing rules?

Visit the IRS Form 1096 page for the latest guidance.

Write a comment ...