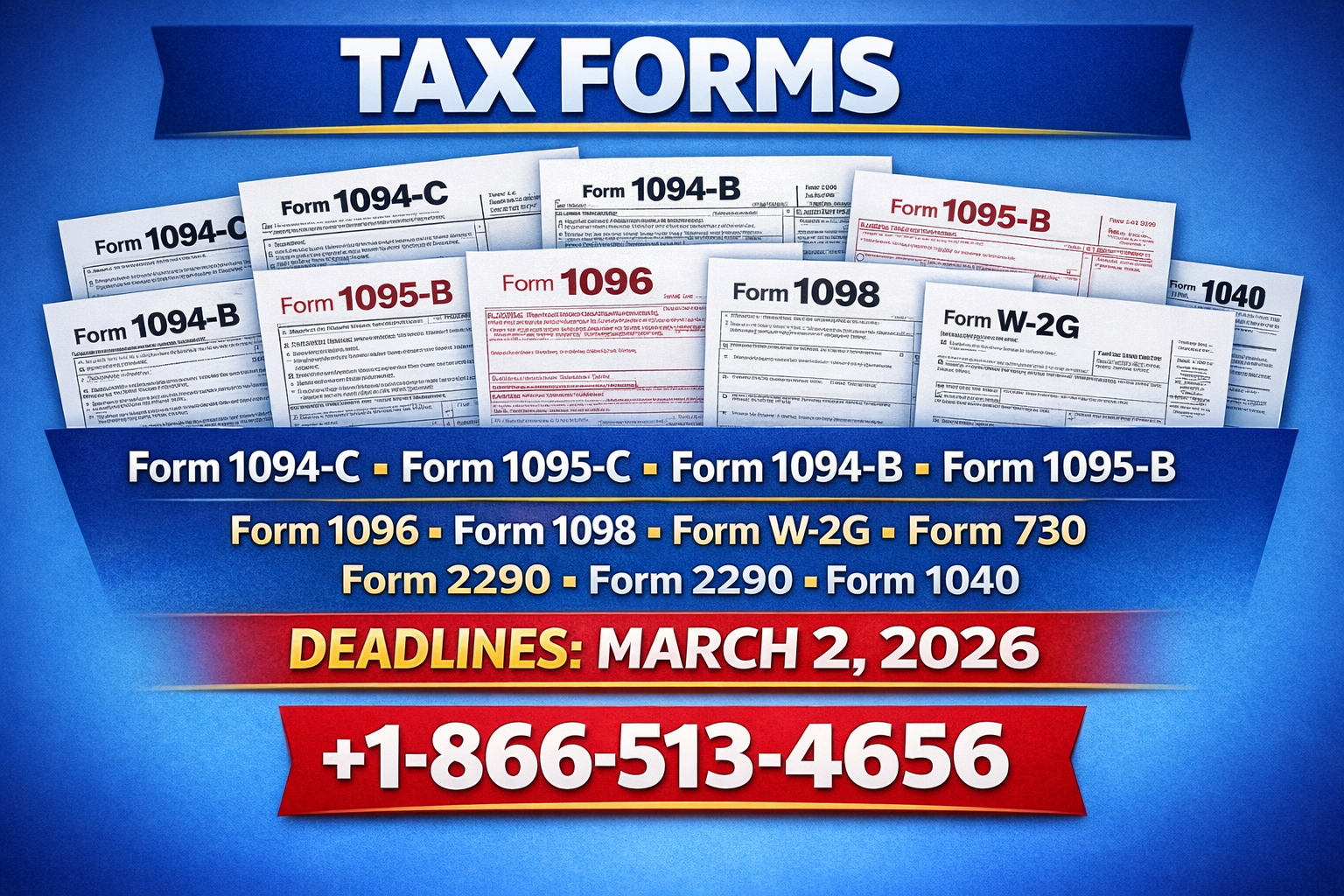

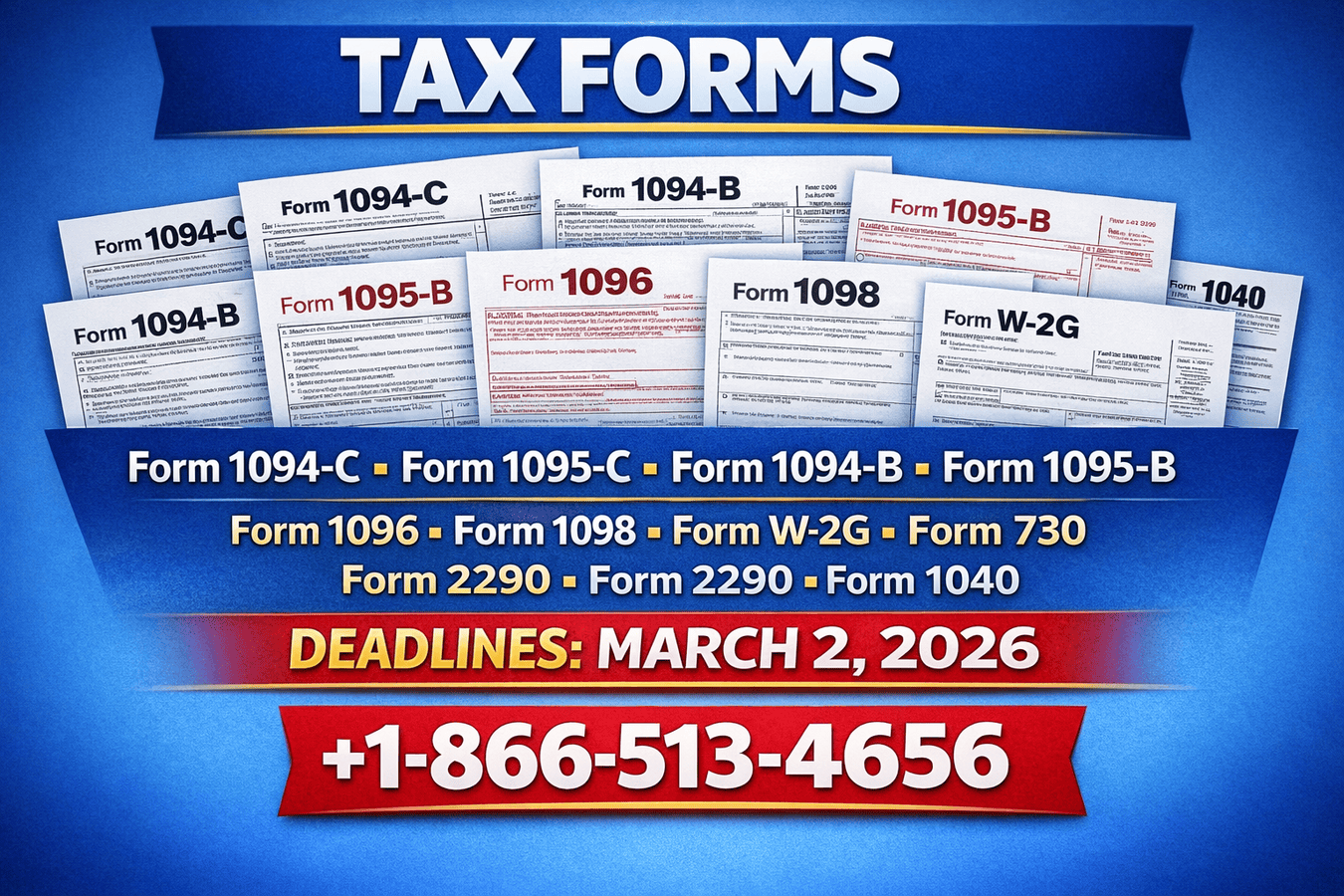

Form 1094-B is the IRS transmittal form that summarizes all employee health coverage information reported on Forms 1095-B, helping employers and insurers stay ACA-compliant.

Form 1094-B – Transmittal of Health Coverage Information Returns (paper). Call +1-866-513-4656 for expert help.

Managing health coverage forms can be tricky, especially when you’re dealing with dozens or hundreds of 1095-B forms. Form 1094-B simplifies the process by acting as a “master summary” for the IRS.

Filing this form correctly not only ensures compliance but also protects employees’ coverage records. If you need professional support, Booksmerge experts are just a phone call away at +1-866-513-4656.

Introduction to Form 1094-B

Form 1094-B, or “Transmittal of Health Coverage Information Returns,” summarizes multiple 1095-B forms for submission to the IRS. It ensures that employee health coverage is properly documented under ACA regulations.

This form is essential for employers and insurers issuing Forms 1095-B. Filing mistakes can lead to IRS notices or penalties.

Who Must File?

Employers and insurance providers who issue Forms 1095-B must file Form 1094-B. This includes self-insured employers and health insurers reporting minimum essential coverage to employees.

Smaller employers without self-insured plans generally do not file. To clarify your filing requirements, call +1-866-513-4656.

Filing Process Step-by-Step

Filing Form 1094-B is easier when you follow a step-by-step approach:

Gather all Forms 1095-B issued for the reporting year.

Complete Form 1094-B with summary totals and filer information.

Attach the Forms 1095-B to the 1094-B transmittal.

Submit the form to the IRS by the required deadline.

Keep copies for your records in case of an IRS review.

Following these steps ensures smooth submission and ACA compliance.

Important Sections

Filer details: name, EIN, address, and contact number

Total number of 1095-B forms submitted

Total number of individuals covered

Type of coverage: self-insured or fully insured

Certification of accuracy and completeness

Completing each section accurately is essential to avoid IRS penalties.

Deadlines and Tips

Paper submissions must be sent to the IRS by February 28 of the following year. Electronic submissions (required for more than 250 forms) are due by March 31. Filing early reduces errors and administrative stress.

Why Accuracy Matters?

Correctly completing Form 1094-B protects employers and insurers from penalties and ensures employees’ coverage information is properly recorded. Accurate reporting demonstrates reliability and administrative compliance.

Trusted IRS Sources

Frequently Asked Questions

1. Who must file Form 1094-B?

Employers and insurers issuing Forms 1095-B are required to file.

2. Do all employers have to submit it?

No. Only those issuing Forms 1095-B, usually self-insured employers and health insurers. =

3. What happens if the form is late?

Late submission may result in penalties. Filing early is recommended. Professional help is available at +1-866-513-4656.

4. Can the form be submitted electronically?

Yes. Electronic filing is required for more than 250 forms, with a deadline of March 31.

Write a comment ...