Form 2290 is used to report and pay Heavy Highway Vehicle Use Tax for trucks and heavy vehicles that first operated on public roads in January.

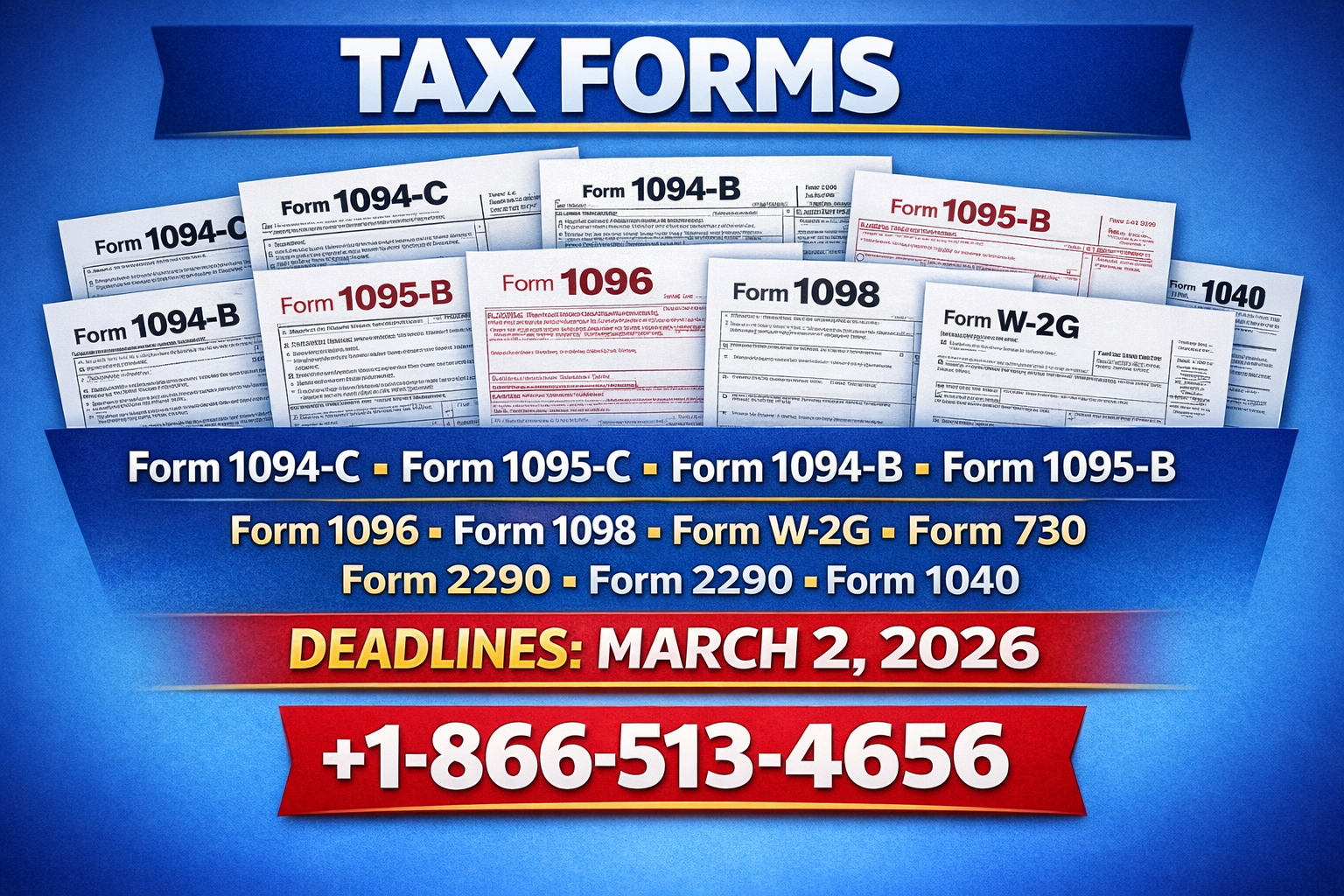

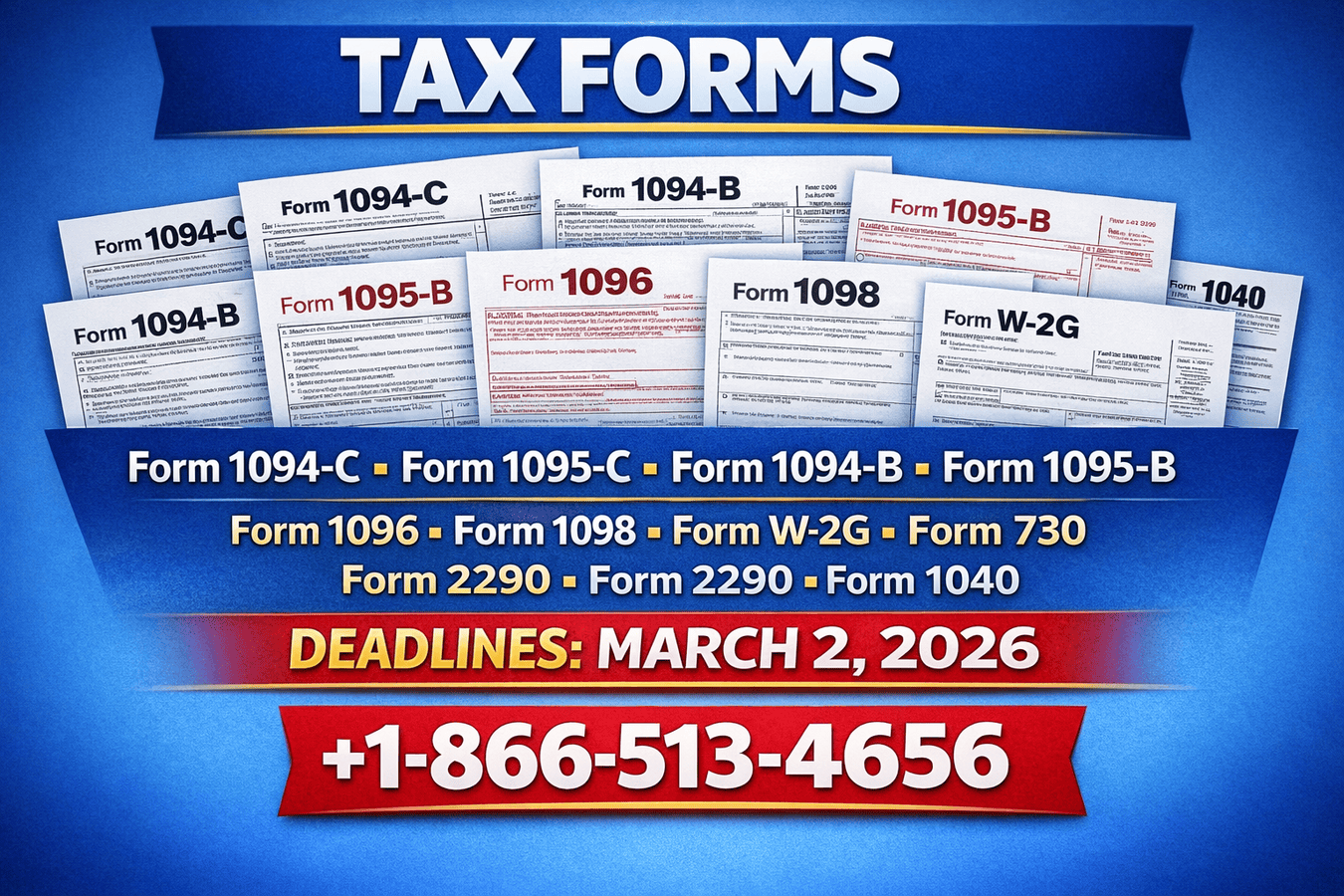

Form 2290 Requirements Explained | March 2, 2026. Call +1-866-513-4656 for further guidance.

Owning or managing a heavy vehicle already comes with enough responsibilities. Tax forms should not add confusion to your day.

If your vehicle first started operating in January, Form 2290 becomes a required step to stay compliant with IRS highway tax rules.

Table of Contents

What Is Form 2290

Why January First Use Matters

Who Needs to File

Understanding the Tax Amount

How to File Without Stress

Trusted IRS Resources

Conclusion

FAQs

What Is Form 2290?

Form 2290 is an IRS tax form used to collect Heavy Highway Vehicle Use Tax from owners of large vehicles.

The tax applies to vehicles with a taxable gross weight of 55,000 pounds or more that operate on public highways. This tax helps maintain roads that heavy vehicles rely on every day.

Official IRS details are available on the IRS Form 2290 page.

Why January First Use Matters?

The IRS defines first use as the month a vehicle begins operating on public roads during the tax period.

If your vehicle first operates in January, you pay a reduced tax amount instead of the full annual tax. This rule keeps the system fair for vehicles that do not run the entire year.

Choosing the correct first-use month plays a major role in accurate filing.

Who Needs to File Form 2290?

You must file Form 2290 if you own or operate:

Heavy trucks or truck tractors

Buses used for transportation

Fleet vehicles registered to a business

Even vehicles driven less than 5,000 miles must still file if they qualify for suspension.

If you need help confirming eligibility, call +1-866-513-4656.

Understanding the Tax Amount

The Heavy Highway Vehicle Use Tax depends on the vehicle’s taxable gross weight. Heavier vehicles pay more because they cause greater road wear.

The IRS uses weight categories to calculate the tax. Selecting the correct category prevents underpayment or overpayment.

You can review tax calculation guidance in the IRS Form 2290 Instructions.

How to File Without Stress

Filing Form 2290 becomes much easier when you follow a clear process:

Verify vehicle weight and VIN

Select January as the first-use month

Submit payment and receive Schedule 1

Schedule 1 acts as proof of payment and is required for vehicle registration.

Many delays happen due to VIN errors or incorrect month selection. For smooth filing, contact +1-866-513-4656.

Trusted IRS Resources

The IRS provides clear and reliable guidance for Form 2290 filers. Helpful resources include the Heavy Highway Vehicle Use Tax Guide.

Using official IRS sources ensures accurate filing and long-term compliance.

Conclusion

Form 2290 remains an essential requirement for heavy vehicles first used in January. Filing it correctly keeps your vehicle legally registered and road-ready.

With the right information and support, compliance stays simple. For professional assistance, call +1-866-513-4656.

Frequently Asked Questions

1. Is Form 2290 required every year?

Yes, owners of qualifying vehicles must file annually if the vehicle operates on public highways.

2. What is Schedule 1 used for?

Schedule 1 confirms payment and is required for DMV registration.

3. Can I correct mistakes after filing?

Yes, amendments are allowed for VIN errors or weight changes.

4. Where can I verify IRS rules?

Visit the IRS Form 2290 official page for accurate information.

Write a comment ...