Form 1095-B is a paper IRS form that reports health coverage details, confirming individuals received minimum essential coverage during the tax year.

Health insurance reporting sounds boring until the IRS asks questions. That is where Form 1095-B steps in. It creates a clear record of health coverage without turning your filing season into a headache.

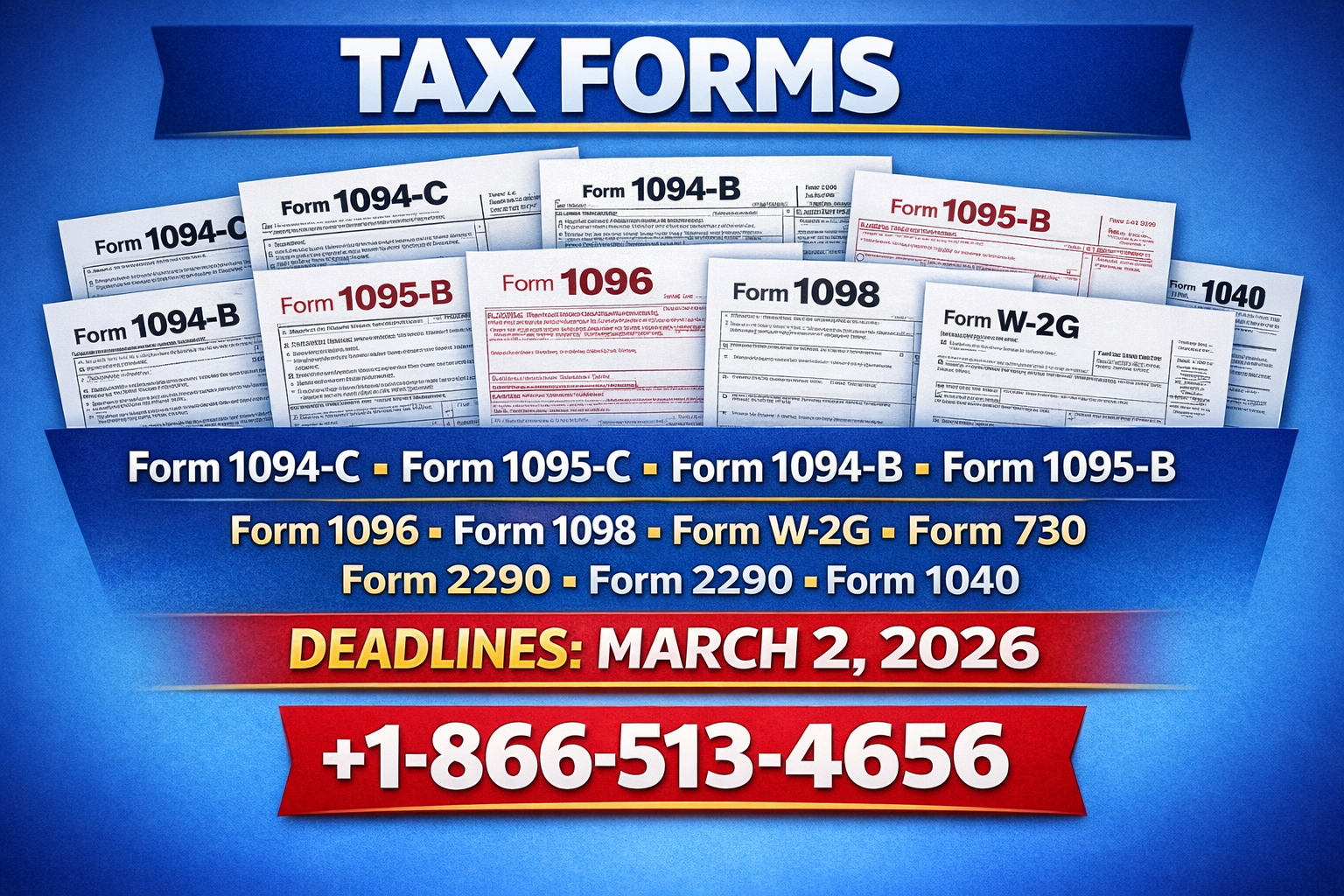

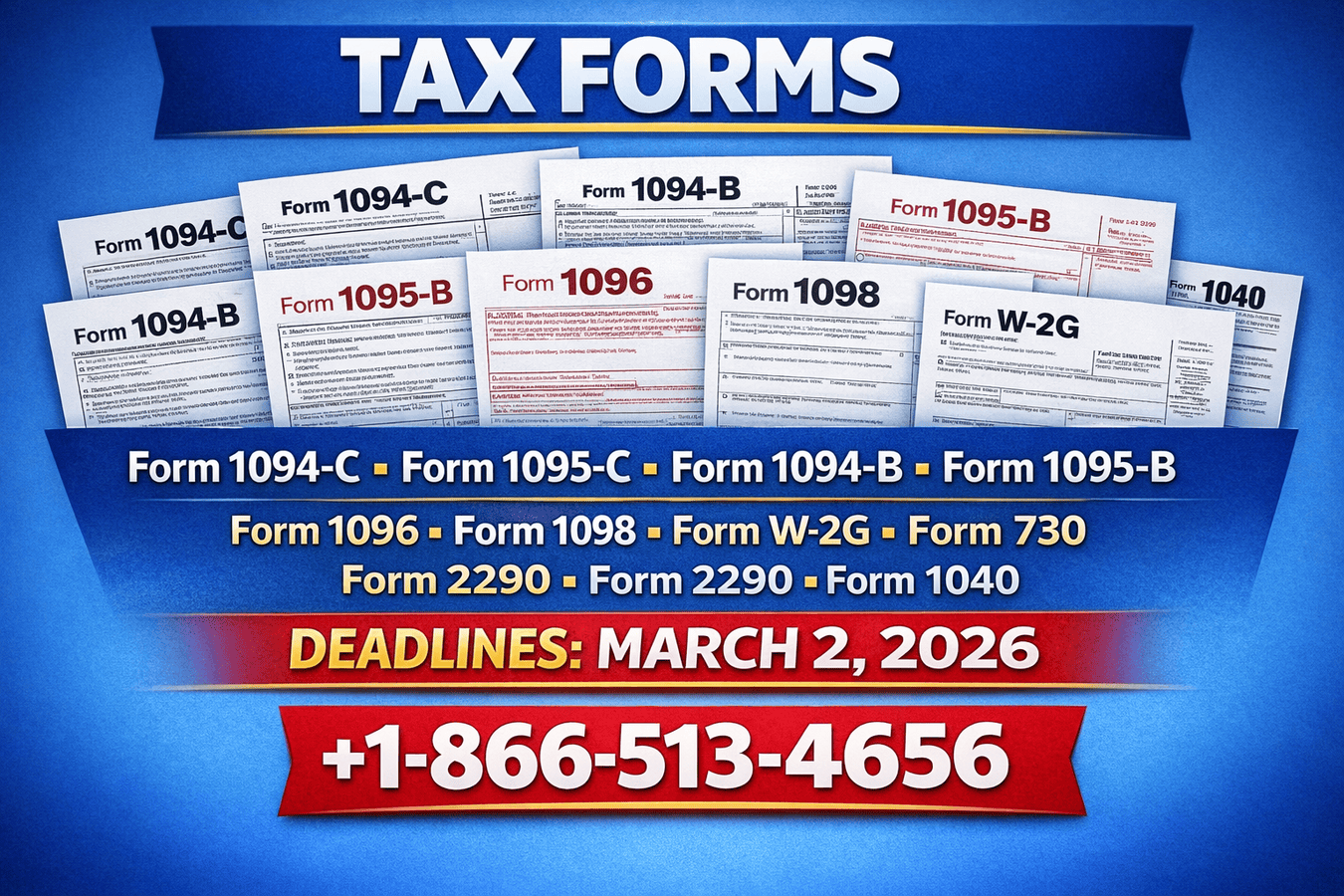

Form 1095-B – Health Coverage Information (paper). If paperwork feels confusing, professional support is available at +1-866-513-4656.

Table of Contents

Form 1095-B Explained

Who Must Issue This Form

What the Form Reports

Paper Filing Steps

Deadlines and Compliance

Trusted IRS References

Summary

FAQs

Form 1095-B Explained

Form 1095-B, titled “Health Coverage Information,” reports whether individuals had minimum essential health coverage. Insurance providers and self-insured employers issue this form to covered individuals and the IRS.

The form supports Affordable Care Act compliance and keeps coverage records clean and verifiable.

Who Must Issue This Form

Not every employer files Form 1095-B. Filing responsibility generally applies to:

Health insurance companies

Self-insured employers

Government health programs

Employees usually receive the form for records only. If filing responsibility seems unclear, call +1-866-513-4656 for guidance.

What the Form Reports

Form 1095-B focuses on coverage confirmation rather than financial data. It includes:

Name and Social Security Number of covered individuals

Employer or insurer identification details

Months when coverage applied

Confirmation of minimum essential coverage

Accurate information avoids corrections and IRS notices.

Paper Filing Steps

Paper filing remains an option when fewer than 250 forms are required. Follow these steps:

Prepare Form 1095-B for each covered individual.

Complete Form 1094-B as the transmittal document.

Mail copies to covered individuals.

Send paper forms to the IRS before the deadline.

Manual filing requires attention to detail. Many businesses choose expert help through +1-866-513-4656 to reduce risk.

Deadlines and Compliance

Deadlines are strict and easy to miss:

Individuals must receive Form 1095-B by early March.

Paper submissions must reach the IRS by February 28.

Electronic filing becomes mandatory for more than 250 forms.

Late filing may lead to penalties, so early preparation pays off.

Trusted IRS References

The IRS provides official guidance that should always be followed:

Using IRS guidance ensures accuracy and strengthens compliance.

Summary

Form 1095-B plays a quiet but important role in health coverage reporting. When filed correctly, it confirms coverage and prevents unnecessary IRS follow-ups.

If you want stress-free filing support, contact +1-866-513-4656 today.

FAQs

1. Do employees file Form 1095-B with their taxes?

No. Employees keep the form for records but usually do not submit it with tax returns.

2. Is paper filing still allowed?

Yes. Paper filing is allowed for fewer than 250 forms.

3. What happens if details are incorrect?

Incorrect information may trigger IRS notices or corrections.

4. Where can I confirm official rules?

Always verify details on the official IRS Form 1095-B page.

Write a comment ...