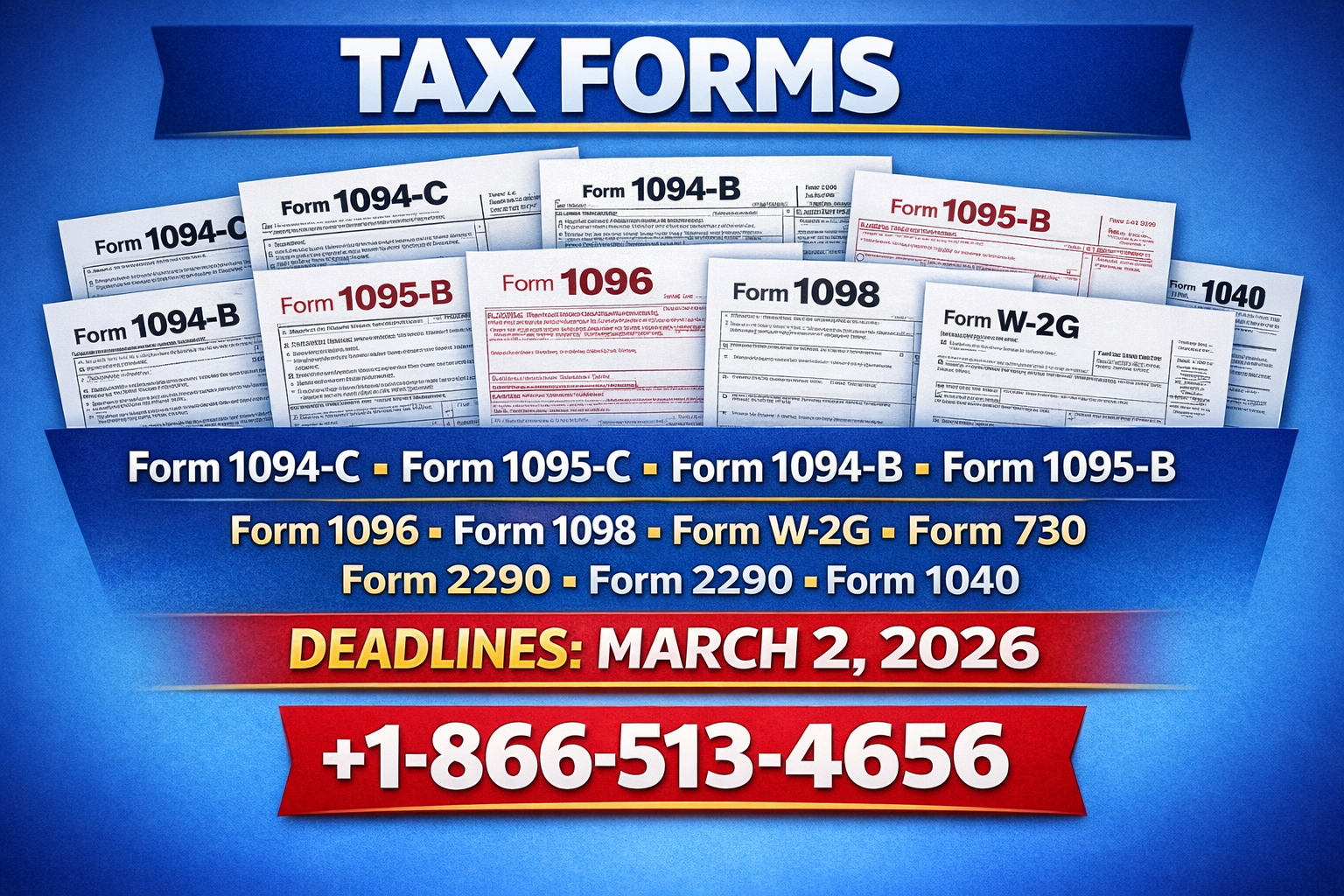

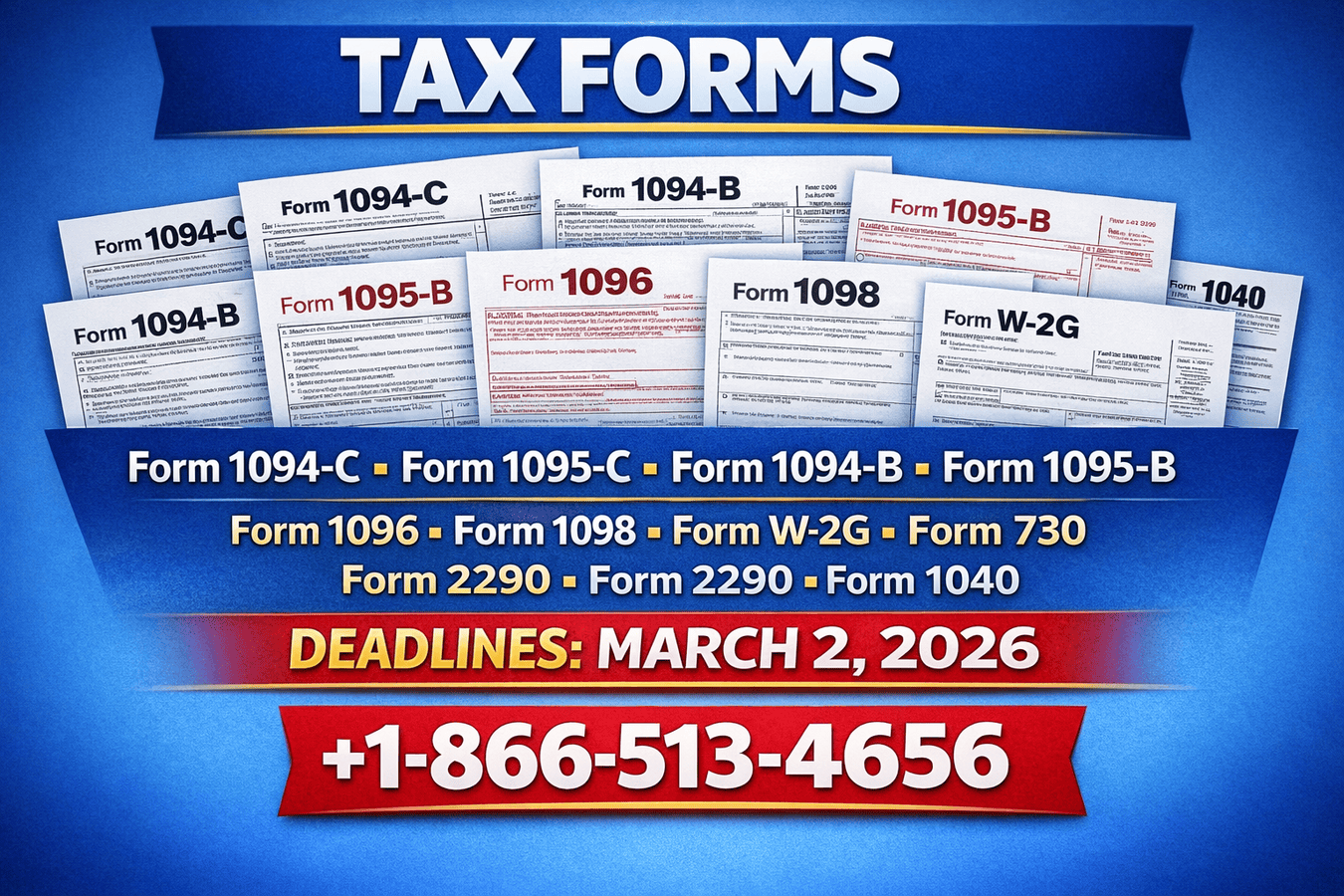

Form 1098 reports mortgage interest and loan related payments, and when submitted by paper, it must be filed with Form 1096 to meet IRS reporting requirements.

Form 1098 Requirements Explained | File by March 2, 2026. Call +1-866-513-4656 for expert guidance and support.

Paper filing still has a place in tax reporting. Many lenders and financial institutions continue to rely on it for controlled and documented submissions.

When Form 1098 is mailed without Form 1096, problems often follow. Understanding how these two forms work together prevents delays.

Table of Contents

Purpose of Form 1098

Why Form 1096 Is Required?

Paper Filing Eligibility

Step by Step Paper Filing Process

Common Filing Challenges

IRS Approved Resources

Conclusion

FAQs

Purpose of Form 1098

Form 1098 allows lenders to report mortgage interest, points, and certain charges paid by borrowers during the year.

The IRS uses this information to match borrower deductions. Accuracy helps avoid audits and correction requests.

Why Form 1096 Is Required?

Form 1096 serves as the IRS summary for paper submissions. It tells the IRS how many Forms 1098 you submitted and the total dollar amounts.

This summary ensures proper scanning and processing. Missing it often leads to IRS notices.

For confirmation before mailing, many filers call +1-866-513-4656.

Paper Filing Eligibility

Institutions that issue fewer forms or have IRS approval may choose paper filing.

Electronic filers do not use Form 1096. Mixing filing methods usually causes reporting errors.

Step by Step Paper Filing Process

Prepare all Forms 1098 accurately.

Order official red-ink Form 1096 from the IRS.

Complete totals carefully on Form 1096.

Attach Form 1096 to the front of Form 1098.

Mail to the IRS address listed in instructions.

Double checking numbers reduces correction filings later.

If deadlines feel tight, assistance is available at +1-866-513-4656.

Common Filing Challenges

Using a copied Form 1096

Incorrect totals on summary form

Submitting multiple form types under one Form 1096

Missing business identification details

These issues often delay processing and increase compliance risk.

IRS Approved Resources

Always refer to official IRS documentation:

These sources ensure compliance and accurate reporting.

Conclusion

Form 1098 paper filing works smoothly when paired with Form 1096. Clear totals and correct documentation keep the IRS process moving.

Booksmerge supports businesses with accurate tax reporting solutions. For reliable assistance, contact +1-866-513-4656 today.

FAQs

1. Is Form 1096 mandatory with paper filed Form 1098?

Yes. The IRS requires Form 1096 for all paper filed Form 1098 submissions.

2. Can I file Form 1098 without Form 1096?

No. Paper filings without Form 1096 often result in IRS processing delays.

3. Does electronic filing require Form 1096?

No. Electronic filing does not use Form 1096.

4. Where can I verify current IRS rules?

Visit the official IRS Form 1098 and Form 1096 pages for updated guidance.

Write a comment ...